Letter from the

Board Management

Read

125 Years

125 action-packed years of a cooperative success model. From the first loans to Bavarian farmers to an international mortgage bank – we are committed to supporting our customers as partners at all times.

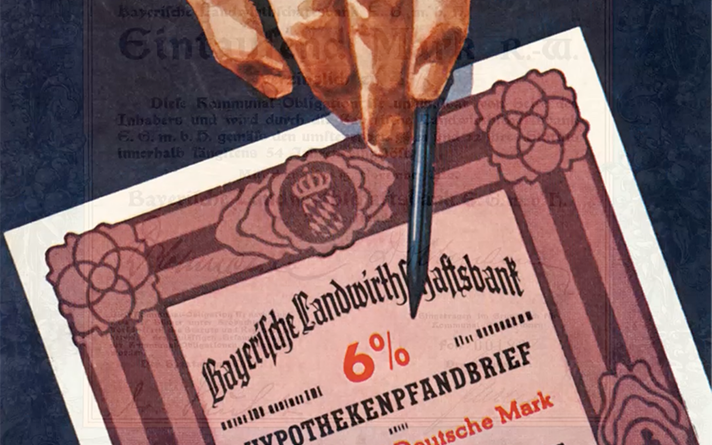

1896

The Bavarian state government wants to alleviate the farmers’ suffering. It founds Bayerische Landwirthschaftsbank – now MünchenerHyp – which lends money to farmers at fair conditions.

1896

The Bavarian state government wants to alleviate the farmers’ suffering. It founds Bayerische Landwirthschaftsbank – now MünchenerHyp – which lends money to farmers at fair conditions.

1897

The crown in the logo: The House of Wittelsbach supported the bank from the very beginning and continues to do so to this day. Prince Max, Duke in Bavaria, was a member of the Supervisory Board from 1991 until 2011, while his daughter Anna, Duchess in Bavaria, has been a member since 2019.

1897

The crown in the logo: The House of Wittelsbach supported the bank from the very beginning and continues to do so to this day. Prince Max, Duke in Bavaria, was a member of the Supervisory Board from 1991 until 2011, while his daughter Anna, Duchess in Bavaria, has been a member since 2019.

1898

What the individual cannot achieve alone, many can achieve together. Bayerische Landwirthschaftsbank is a registered cooperative. Today, it is MünchenerHyp and has 64,000 members.

1898

What the individual cannot achieve alone, many can achieve together. Bayerische Landwirthschaftsbank is a registered cooperative. Today, it is MünchenerHyp and has 64,000 members.

1918

After the First World War, the bank’s situation seems desperate. By granting interest-free loans, the Bavarian state government ensures that the bank has a future again.

1918

After the First World War, the bank’s situation seems desperate. By granting interest-free loans, the Bavarian state government ensures that the bank has a future again.

1945

Peace at last! Yet the bank’s building is destroyed at the very end of the war. Bank employees pitch in to help rebuild the bank on another plot on Nussbaumstrasse in Munich.

1945

Peace at last! Yet the bank’s building is destroyed at the very end of the war. Bank employees pitch in to help rebuild the bank on another plot on Nussbaumstrasse in Munich.

1971

New times, new name: To this day, “Münchener Hypothekenbank” increasingly finances apartments and houses together with Volksbanks and Raiffeisenbanks. Loans of EUR 3.1 billion are granted in 2020.

1971

New times, new name: To this day, “Münchener Hypothekenbank” increasingly finances apartments and houses together with Volksbanks and Raiffeisenbanks. Loans of EUR 3.1 billion are granted in 2020.

2014

From the very beginning, the Pfandbrief is MünchenerHyp’s most important source of refinancing. It issues the world’s first sustainable Pfandbrief in 2014.

2014

From the very beginning, the Pfandbrief is MünchenerHyp’s most important source of refinancing. It issues the world’s first sustainable Pfandbrief in 2014.

2021

MünchenerHyp has changed: It is now one of the most important banks in Europe and funds office buildings and housing in Europe and America. Its cooperative spirit has held for 125 years: Together we are strong.

2021

MünchenerHyp has changed: It is now one of the most important banks in Europe and funds office buildings and housing in Europe and America. Its cooperative spirit has held for 125 years: Together we are strong.

Key Figures

2021

Mortage Portfolio Development

(bn €)

Paid-up capital

(bn €)

1.243

2020: 1.153 bn €

Net interest income and net comission income (m€)

272

2020: 238 m€

New Mortage Business

(bn €)

6.8

2020: 6.4 bn €

Residential

property

financing

Commercial

property

financing

Common Equity Tier 1 Ratio

20,4%

2020: 20,6 %

Employees

| A 14 | Apprentices |

| B 38 | Employees in parental leave, early retirement and partial retirement |

| C 624 | Average number of employees per year |